[ad_1]

As many as 80% of aging adults in America lack the monetary sources to pay for 2 years of nursing house care or 4 years of an assisted residing group.

That is in keeping with a brand new examine from the Nationwide Council on Getting older (NCOA) and the LeadingAge LTSS Middle on the College of Massachusetts Boston.

Moreover, 60% of older adults — or 24 million households — wouldn’t have the funds to pay for in-home long-term care, although they would favor to “age in place,” per a report from NCOA.

Researchers analyzed 2018 knowledge from the Well being and Retirement Examine, which was a joint effort by the Nationwide Institute on Getting older and the Social Safety Administration that surveyed some 20,000 U.S. adults about their internet wealth.

IN ALZHEIMER’S STUDY, SLEEPING PILLS ARE SHOWN TO REDUCE SIGNS OF DISEASE IN THE BRAIN

When the researchers first started wanting on the knowledge a number of years in the past, they had been initially stunned to see that so many older adults had been at vital threat of monetary insecurity, Dr. Jane Tavares, a lead researcher on the LTSS Middle at UMass Boston, instructed Fox Information Digital.

“There’s a widespread false impression that older adults are asset-rich, however now we have present in our analysis that this isn’t typically true,” she mentioned.

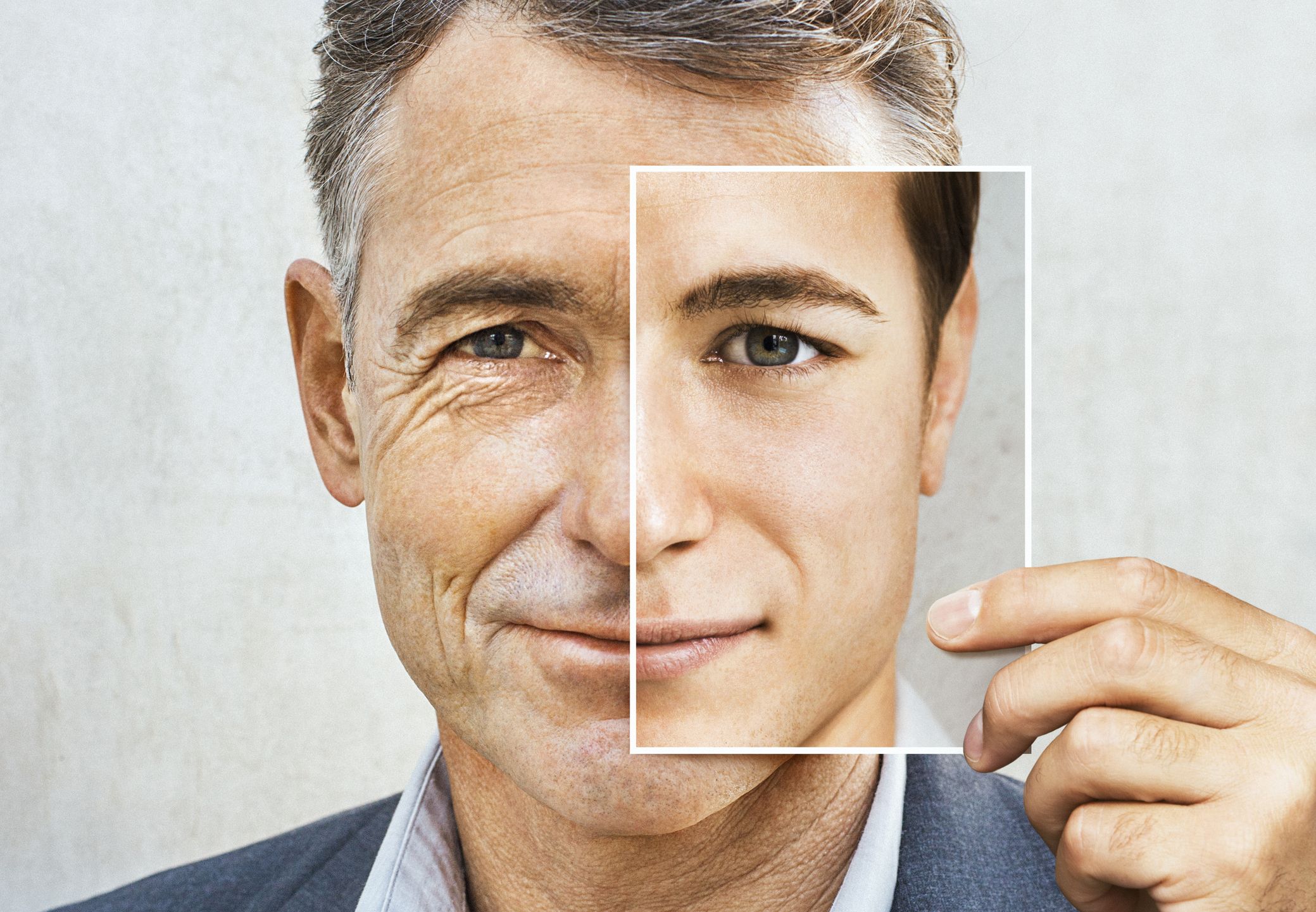

As much as 80% of ageing adults in America lack the monetary sources to pay for 2 years of nursing house care or 4 years of an assisted residing group, a brand new examine discovered. (iStock)

Dr. Tavares additionally famous, “We anticipate that there’ll in all probability be some worsening as soon as we look at knowledge for the time interval protecting the COVID pandemic.”

Rising prices of assisted residing

The nationwide common value for assisted residing is round $4,500 per thirty days, in keeping with the 2021 Value of Care Survey from Genworth, a Virginia-based company that helps older adults with monetary planning.

“The price of assisted residing can range considerably relying on the situation and stage of care wanted,” mentioned Dr. Steven Norris, a senior well being and care skilled who can also be the medical director at Transitions Care in Chicago, Illinois.

“Because the inhabitants continues to age and demand for these providers grows, it’s seemingly that the fee will proceed to rise,” he mentioned.

With the widespread scarcity of certified caretakers, amenities are having to pay extra to safe the precise folks, the physician defined.

“For many years, there was a lack of knowledge of how costly assisted residing actually is.”

“Moreover, current will increase in minimal wage necessities and adjustments in extra time fee laws are rising assisted residing prices,” he mentioned.

The associated fee might vary from $3,000 in rural areas to $7,000 to $9,000 in city places, famous Bennett Kim, a senior housing skilled and CEO of Las Vegas-based ZNest. It is an internet platform designed to assist older adults discover locations to stay.

Upscale assisted residing might be larger than $12,000 per thirty days.

The altering retirement mannequin has additionally contributed to gaps in financial savings for America’s senior residents, specialists say. (iStock)

“For many years, there was a lack of knowledge of how costly assisted residing actually is,” Kim instructed Fox Information Digital.

“Some folks thought medical insurance would cowl long-term care prices, whereas different folks optimistically believed that they might live a healthy life forever.”

The pandemic hasn’t helped issues, because the trade noticed a surge in working bills, Kim mentioned.

Center-aged and older adults are dealing with a really totally different monetary panorama than the generations earlier than them did.

“Assisted residing firms needed to frequently elevate costs simply to maintain up with their prices, however retirees didn’t see the identical development in financial savings or investments,” he added.

A number of elements contribute to monetary struggles

Center-aged and older adults at the moment are dealing with a really totally different monetary panorama than the generations earlier than them did, Tavares identified.

“For starters, better longevity comes with a better value, in addition to a better threat of dealing with critical chronic health conditions,” she instructed Fox Information Digital.

WEIGHT LOSS IN OLDER ADULTS ASSOCIATED WITH RISK OF DEATH, STUDY SHOWS

Moreover, the will increase in family revenue and property haven’t been massive sufficient to maintain up with the rising prices of residing, health care and inflation, she added.

And even when older adults do have property, they’re typically tied up in property and never available to assist them cowl prices, Tavares defined.

The nationwide common value for assisted residing is round $4,500 per thirty days, in keeping with a 2021 survey. Value varies relying on location and the extent of care wanted. (iStock)

The altering retirement mannequin has additionally contributed to gaps in financial savings.

Whereas previous generations had non-public, employer-sponsored pensions that offered predictable funds, many Individuals now depend on 401(Ok) accounts, which depart people answerable for saving sufficient cash to cowl their retirement years, Tavares mentioned.

“With all of this mixed, few older adults have any sort of vital financial savings in retirement accounts — and most cannot afford long-term care insurance coverage that might assist cowl the costly prices of assisted residing or nursing house care,” she defined.

ADDITIONAL EXERCISE POTENTIALLY LINKED TO LONGER LIFESPANS AND LOWER DEATH RATES: STUDY

“This implies there’s a better reliance on Social Safety revenue and social security internet packages like Medicaid.”

Potential options exist — however many seniors aren’t conscious of them

There are over 2,500 public state and federal profit packages designed to spice up older adults’ financial safety — however lots of them should not getting used to their full extent, in keeping with Tavares.

“Many of those packages are under-enrolled, with people not realizing they exist or not realizing about their eligibility standing and easy methods to apply,” she instructed Fox Information Digital.

“There’s a widespread false impression that older adults are asset-rich.”

In 2020, an estimated $30 billion of public advantages went unused annually, per the Nationwide Council on Getting older.

“These packages are an necessary buffer for monetary insecurity, and it’s important that they’re correctly utilized and maintained by state and federal governments,” Tavares mentioned.

Sixty p.c of older adults — 24 million households — wouldn’t have the funds to pay for in-home long-term care, the examine discovered. (iStock)

Schooling is seen as one other key element of bettering seniors’ monetary stability.

SECRETS OF STAYING AGELESS: FOUR FLORIDA SENIORS REVEAL HOW TO HIT A HOME RUN FOR GOOD HEALTH

“This implies educating people about retirement financial savings and techniques for figuring out when to file for Social Safety that consider their sources of retirement revenue/financial savings, well being and realistic retirement goals,” Tavares mentioned.

“People have to be occupied with and getting ready for the way they may climate a possible monetary shock as they age,” she added, “and policymakers have to be ready for the heavy monetary burden that may seemingly fall on public state and federal profit packages and start crafting options for dealing with that burden.”

CLICK HERE TO SIGN UP FOR OUR HEALTH NEWSLETTER

Some older adults might have the choice to faucet into their house fairness to fund their retirement, however Tavares mentioned they want sources that assist them perceive and navigate that course of.

“People have to be occupied with and getting ready for the way they may climate a possible monetary shock as they age.” (iStock)

There’s additionally a transparent want for policymakers to enhance long-term care protection, in keeping with Tavares.

“With non-public long-term care insurance being unaffordable for many older adults, it’s key to start contemplating mixed private and non-private initiatives that may put the price of protection inside attain and make it extra interesting to customers,” she mentioned.

Future analysis is deliberate

The LTSS Middle at UMass Boston and the Nationwide Council on Getting older plan to proceed updating these studies as new knowledge turns into obtainable.

CLICK HERE TO GET THE FOX NEWS APP

Researchers are already engaged on analyzing the impression of the COVID pandemic on these monetary developments, Tavares mentioned.

[ad_2]

Source link