[ad_1]

From Melbourne to Manchester to Miami, individuals are struggling beneath the burden of hefty worth will increase for the issues they purchase every day.

The worst spike in inflation that many superior economies have seen in many years underscores the worldwide forces driving costs increased, specifically the disruptions set in movement by the coronavirus pandemic.

The stakes are excessive for policymakers world wide, who’re dealing with related issues. To attempt to get inflation beneath management, central bankers have quickly lifted rates of interest, attempting to gradual their economies in hopes of cooling costs.

In the event that they fail to deliver inflation beneath management, it might end in a destabilizing interval of spiraling costs. Larger and fewer predictable inflation would squeeze households and companies and make it tougher to plan for the long run.

But when financial policymakers react too aggressively — and suddenly — it might crimp world financial development to a painful diploma. That might elevate the danger of a serious recession that shutters companies and places folks out of labor. Given the potential price, policymakers don’t need to overdo it, harming their economies greater than is critical to deliver down inflation.

Many central banks are approaching these trade-offs equally: They’re centered on preventing stubbornly excessive inflation. Officers worry that in the event that they let inflation persist for too lengthy, it might grow to be entrenched and show much more painful to stamp out.

The leaders of main central banks in North America, Europe and elsewhere have mentioned lately that they expect to continue raising rates, as inflation is moderating however stays effectively above their typical goal charges — which are sometimes round 2 %.

Officers on the U.S. Federal Reserve have raised their coverage charge to simply above 5 % from close to zero in March 2022, and so they forecast elevating it two more times in 2023, to simply above 5.5 %. Policymakers on the European Central Financial institution, which units coverage for the 20 nations that use the euro, additionally expect to continue raising rates, which have reached the best degree since 2001. The Financial institution of England lately stunned traders by elevating charges more than expected with its thirteenth consecutive enhance.

Inflation surged considerably in the USA in 2021 however has come down extra shortly than in lots of elements of Europe. That’s partly as a result of Europe has extra important publicity to the consequences of Russia’s invasion of Ukraine, which has pushed up meals and vitality costs sharply.

However stripping out these risky costs, so-called core inflation appears cussed throughout many nations. That underscores the widespread drawback dealing with policymakers: Sluggish-moving costs for providers are climbing far more shortly than earlier than the pandemic.

Costs for labor-intensive providers like medical care and training have a tendency to trace wage gains and the power of the general financial system. Briefly, they’re the kind of worth will increase that central banks can do one thing about by elevating charges to decelerate borrowing, curb spending and finally cool the financial system.

At a current gathering of central bankers, Jerome H. Powell, the Fed chair, mentioned that for inflation within the providers sector, resembling motels, eating places and banks, “we aren’t seeing quite a lot of progress but.”

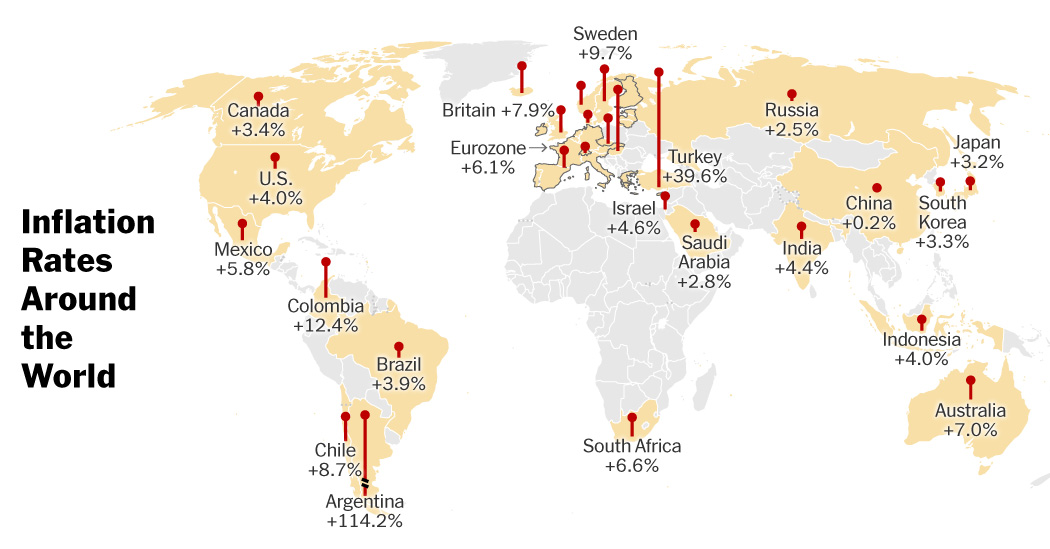

Chart sources: FactSet (coverage charges); Group for Financial Cooperation and Improvement (inflation charges).

The map consists of O.E.C.D. members and chosen main economies. The road charts present the newest central financial institution coverage goal charges, and year-over-year adjustments in shopper worth indexes as compiled by the O.E.C.D. as of Might. For Australia, the change in shopper costs is for the primary quarter of the yr.

Eshe Nelson contributed reporting.

[ad_2]

Source link