[ad_1]

Tax hikes and extra VAT netted from hovering costs have helped bolster Treasury coffers and decrease UK borrowing.

The funds deficit in June stood at £18.5bn, down from £20bn a month earlier, the Workplace for Nationwide Statistics (ONS) mentioned.

It was additionally decrease than the £22bn specialists had forecast.

The June deficit took borrowing within the first three months of the monetary yr to £54.4bn, £12.2bn greater than in the identical interval final yr however £7.5bn lower than anticipated by funds forecasters.

The ONS additionally revised down its April-Might borrowing estimate by £7bn with stronger than predicted tax revenues following will increase introduced by the federal government in November final yr.

Excessive inflation driving costs has additionally performed a task, with VAT receipts up 9% this monetary yr in contrast with a yr in the past, regardless of no enhance within the underlying charge.

Nonetheless, borrowing stays excessive after the shocks of the coronavirus pandemic and final yr’s power worth surge fuelled by the Ukraine conflict.

Final month’s determine remains to be the third most the federal government has borrowed in any June since 1993.

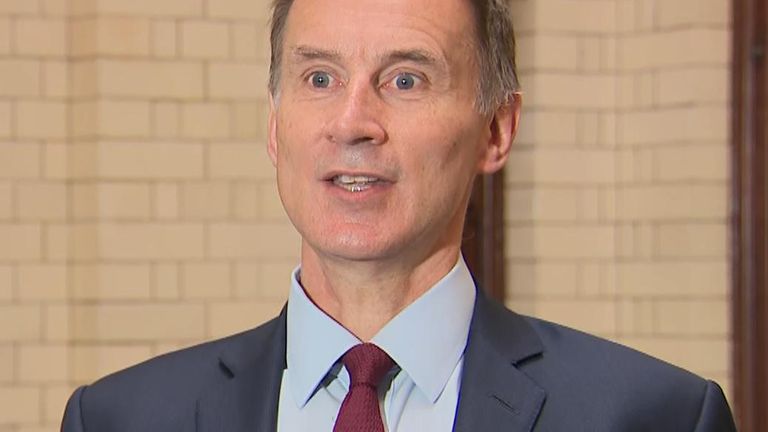

Prime Minister Rishi Sunak and Chancellor Jeremy Hunt have thus far resisted requires tax cuts from their very own backbenches forward of a normal election anticipated subsequent yr, with the celebration trailing behind Labour within the opinion polls.

The Tories lost two parliamentary seats on Friday and only narrowly held another.

Learn extra:

Average mortgage rates edge up again

Retail sales jumped 0.7% last month

Responding to the borrowing figures, Mr Hunt mentioned: “Now greater than ever we have to preserve self-discipline with the general public funds.

“We’re at an important juncture and have to keep away from reckless spending.

“As this week’s fall in inflation confirmed, we are going to begin to see outcomes if we persist with our plan to halve inflation, develop the economic system and get debt falling.”

Additionally serving to the federal government has been a better-than-expected efficiency by the economy in early 2023 which, whereas successfully flatlining, has thus far prevented a recession.

Subscribe to the Ian King Business Podcast here

The COVID-19 disaster precipitated authorities borrowing to soar and public debt was larger than the nation’s financial output in June.

Nonetheless, it’s not the primary time in recent times the UK was thought to have handed the 100% of GDP milestone just for the information to be revised later.

The curiosity the federal government paid on its debt final month was £12.5bn, which remains to be the third-highest of any month on report, regardless of being considerably lower than the £20bn funds in June final yr.

Samuel Tombs, an economist with Pantheon Macroeconomics, mentioned the higher information on latest public borrowing wouldn’t be celebrated a lot on the Treasury because the outlook for debt curiosity funds had worsened.

He mentioned: “We proceed to assume that the chancellor won’t have scope to chop taxes meaningfully earlier than the following normal

election.”

[ad_2]

Source link