[ad_1]

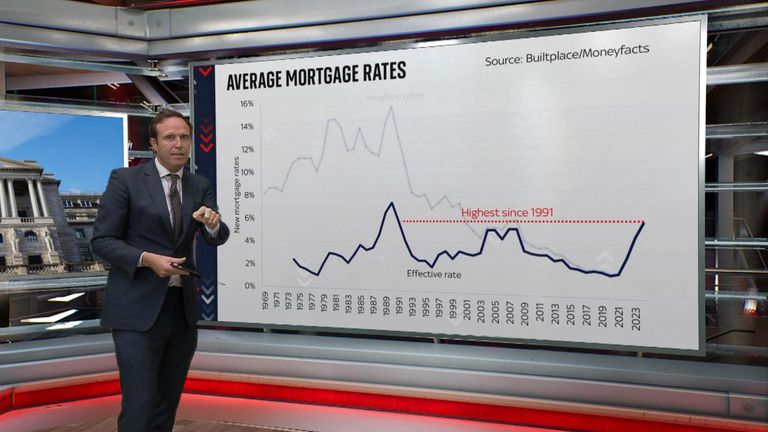

Mortgage payers taking out new loans immediately are actually dealing with the most important dwelling mortgage squeeze because the early Nineteen Nineties housing crash, with the ache solely set to worsen within the coming months.

The typical charge on a brand new five-year mortgage has now ticked as much as 5.54%, in response to Moneyfacts.

That is, in headline phrases, the very best stage since 2008.

Nonetheless, when you regulate for the truth that immediately’s mortgage holders have greater debt and decrease incomes relative to their month-to-month funds, the present burden is the very best since 1991, when headline new mortgage charges averaged practically 13%.

The present charge on two-year mortgage fixes is even greater at 5.9 %, which in headline phrases is the very best since 2000.

Nonetheless, with markets now anticipating the Bank of England (BoE) to boost its official rate of interest as excessive as 5.75% by the flip of the approaching 12 months, the mortgage squeeze is projected to worsen.

The charges paid by shoppers are usually greater than the official Financial institution charge.

The upshot is that it’s not implausible that the compensation burden for these refixing their mortgages might quickly equal or surpass the height within the late Eighties.

BoE behind the curve?

It comes amid rising consternation in regards to the stage of each worth and wage inflation within the UK, with economists questioning whether or not the Financial institution is dangerously behind the curve on the price of residing, and should carry borrowing prices to painful ranges to convey it again below management.

The rate of interest on two-year UK authorities bonds is now greater than it was after the mini-budget final 12 months.

The explanations are considerably completely different: the leap final 12 months was partly a symptom of monetary instability following the short-lived tax slicing plans introduced by the then chancellor Kwasi Kwarteng.

The present leap is essentially right down to recent surprises on inflation.

Economists warn that with the UK dealing with probably greater worth rises than many different main economies, British rates of interest could possibly be greater for a while to return. That in flip raises the probabilities of a recession.

[ad_2]

Source link