[ad_1]

It is an unsightly phrase for an unsightly phenomenon. ‘Greedflation’ is the brand new buzzword in economics.

The thesis is sort of easy. Whereas a sure chunk of the inflation we’re presently dwelling via can undoubtedly be put all the way down to increased power costs and a bit put all the way down to increased wages as employers go these prices onto their staff, there is a sizeable chunk that comes again to one thing else: income.

Some economists argue that companies are utilizing the cost of living crisis as a possibility to generate extreme income.

This is not simply an idle principle. Economists on the European Central Financial institution (ECB) even have some statistical proof to again it up.

You possibly can solely be taught a lot by breaking down the buyer worth index, the standard measure of rising costs (inflation, let’s not overlook, is solely the speed at which the costs of the typical items and companies we spend most of our cash on change every year).

Which may inform you how a lot is all the way down to meals worth inflation however it may possibly’t provide you with a way of how a lot of that given enhance in meals costs is benefiting staff versus their employers.

However there’s one other method of skinning the numbers. You possibly can look as an alternative at one other measure of costs, one thing referred to as the gross home product deflator.

Taking a look at costs this manner, by way of one other dataset, lets you work out how a lot of the pricing stress we’re presently seeing could be put all the way down to income and the way a lot all the way down to wages (or certainly different components like taxes).

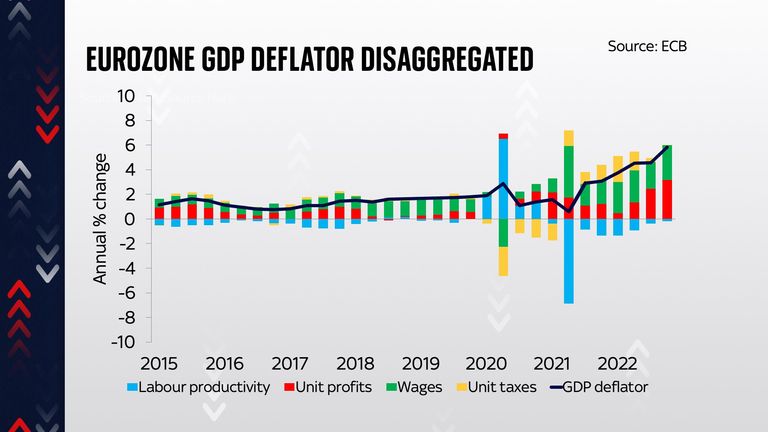

And the ECB chart is fairly stark:

The important thing factor to take a look at are the purple slices of the bar. That is displaying you ways a lot of the rise in costs previously few years could be attributed to income.

And it is fairly clear that income have been a substantial chunk of the current will increase in costs. Certainly, in the newest couple of quarters of knowledge, for late 2022, income accounted for extra of the rise in costs than wages (the inexperienced slices).

Now, some would argue that this is not essentially profiteering. It is merely companies doing what they at all times do when there’s a lot of demand for items and elevating their costs.

With out that response, the market as we all know it merely would not operate. Nonetheless, some say it underlines {that a} good chunk of the value squeeze is because of the greed of companies.

So that is the eurozone. How concerning the UK?

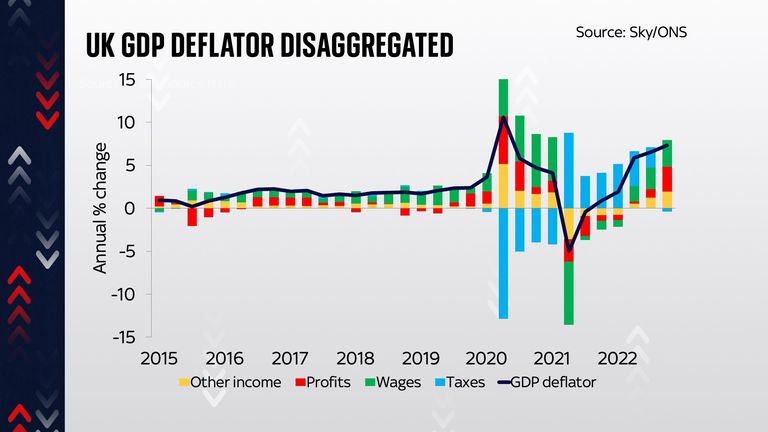

Nicely previously few days we at Sky Information have finished an analogous train to the ECB, utilizing our personal GDP deflator knowledge to create our personal ‘greedflation’ chart. And this is what it exhibits:

A number of apparent issues leap out. The primary is that big spike in costs after which the autumn throughout COVID and its aftermath.

So far as I can inform this was largely a operate of the truth that wider measures of the economic system have been everywhere in the store.

It is fairly onerous to understand how a lot to learn into something occurring throughout this yo-yo as for all we all know it might be a statistical aberration (maybe worthy of some additional research).

However now have a look at the purple slices. Whereas the slice is definitely fairly huge within the very newest quarter for which we’ve knowledge (the ultimate quarter of 2022), even in that quarter income have been nonetheless barely smaller as a part a part of the GDP deflator than wages.

And look a little bit additional again and truly the contribution of income to costs was far, far smaller than within the eurozone.

In different phrases, if that is our greatest statistical measure of ‘greedflation’ – and it appears to be – then we’ve significantly much less of it right here within the UK than there’s on the opposite facet of the Channel.

Tempting as it’s guilty companies for what we’re struggling via, there’s not an unlimited quantity of proof from these figures that they’re the primary perpetrator. Truly, taxes (in different phrases the federal government) contributed way more to inflation in 2021 and into 2022 than enterprise income.

Now, with Britain dealing with double-digit inflation, a depressing price of dwelling disaster and rising rates of interest, the above may not be of a lot comfort. And it is fairly doable the numbers might nicely shift – be aware that these figures are a little bit gradual to be up to date, so we do not know the image as of the early a part of this yr.

Even so, it is a reminder that the information typically tells a subtly completely different story to the mainstream narrative.

[ad_2]

Source link