[ad_1]

UK vitality chiefs will collect in Downing Avenue right this moment to debate web zero as a debate rages in each fundamental events about the way forward for inexperienced insurance policies.

Trade leaders from EDF, SSE, Shell and BP will meet Grant Shapps, the vitality safety secretary, simply days after the federal government introduced it might grant greater than 100 new oil and fuel licences off the coast of Scotland – a transfer critics declare would drive “a wrecking ball by means of the UK’s local weather commitments”.

Mr Sunak has defended the brand new licences, arguing that utilizing home oil and fuel saved “two, three, 4 instances the quantity of carbon emissions” than “transport it from midway around the globe”.

Nonetheless, he was criticised by these in his personal celebration, together with former vitality minister Chris Skidmore, who mentioned it was “the incorrect choice at exactly the incorrect time, when the remainder of the world is experiencing report heatwaves”.

Mr Shapps is predicted to focus on the federal government’s North Sea announcement in addition to effectively because the steps it has taken to bear down on protests teams comparable to Simply Cease Oil – whom the Tories are eager to painting as intently aligned to the Labour Social gathering.

He’s anticipated to say: “We have to ship the message loud and clear to the likes of Putin that we’ll by no means once more be held to ransom with vitality provide. The businesses I’m assembly in Downing Avenue right this moment shall be on the coronary heart of that.

Rutherglen and Hamilton West by-election after Margaret Ferrier loses seat – politics latest

“Vitality trade leaders can see that this authorities will again homegrown, safe vitality – whether or not that is renewables, our revival in nuclear or our help for our very important oil and fuel trade within the North Sea.”

In accordance with the Division for Vitality Safety and Internet Zero, Shell UK plans to take a position £20-25bn within the UK vitality system over the following 10 years, whereas BP intends to take a position as much as £18bn within the UK to the top of 2030.

SSE plc have additionally introduced plans to take a position £18bn as much as 2027 in low carbon infrastructure and Nationwide Grid plc shall be investing over £16bn within the five-year interval to 2026. EDF has outlined plans to take a position £13bn to 2025.

The assembly with Mr Shapps comes simply weeks after the Uxbridge by-election sparked a debate inside each events over how you can promote inexperienced insurance policies to the general public, after Labour’s slim defeat was blamed on Sadiq Khan’s extremely low emission zone’s (ULEZ) deliberate growth to outer London.

The consequence has prompted MPs on the best of the Conservative Social gathering to attraction to the PM to rethink the federal government’s web zero commitments, with requires delays to various targets – together with placing again the ban on the sale of petrol and diesel automobiles from 2030 to 2035.

One other strain bearing on Mr Sunak is over whether or not the federal government ought to maintain its oil and windfall tax after BP last week reported £2bn in net profits.

The £2bn determine was in reality half the $5bn (£4bn) revenue the agency achieved within the previous three months within the first quarter of 2023.

The Liberal Democrats mentioned that nonetheless, the “monster earnings” can be a “nasty shock to households who could not afford to warmth their houses this 12 months”.

The celebration’s Treasury spokesperson Sarah Olney mentioned: “The federal government should not be hoodwinked to take away the windfall tax by this revenue drop. Let’s be frank, these are nonetheless big.

“No household ought to go chilly subsequent winter as a result of the federal government backed down on taxing the likes of BP.

“It’s time to put the wants of struggling households and pensioners over the wallets of world oil corporations.”

The federal government has mentioned it’ll end the windfall tax on bumper oil and gas profits in 2028 if prices drop.

The windfall tax – 75% of North Sea oil and fuel manufacturing earnings – will proceed for the following 5 years but when costs fall to traditionally regular ranges for six months, the tax price for oil and fuel firms will return to 40%.

Learn extra:

There’s a lot of noise in the debate over North Sea oil and gas – but the numbers tell a different story

What are the Tories’ green policies – and what could be scrapped?

Firms don’t pay the complete 75% or 40% price as they’ll offset tax liabilities on funding they make.

The windfall tax, which is also called the vitality earnings levy, has raised round £2.8bn up to now and is predicted to boost virtually £26bn by March 2028, based on the federal government.

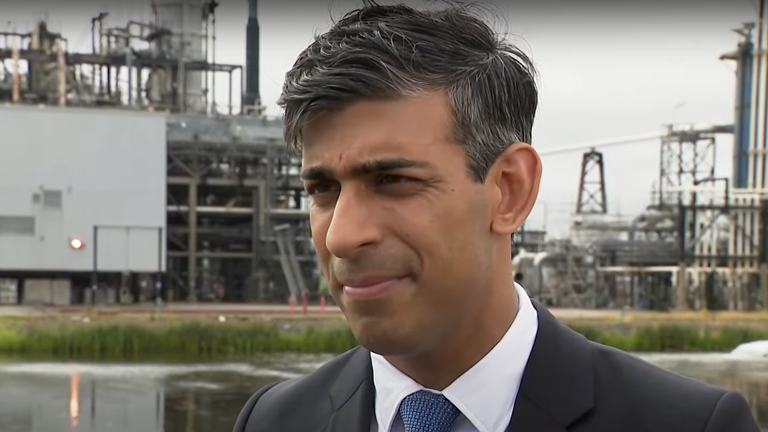

Requested about BP’s earnings throughout a go to to Teesside’s transmission system fuel terminal on Tuesday, Mr Shapps mentioned: “I feel what individuals need to know is that they [BP] are being correctly taxed, and we have been taxing them 75% of their earnings by means of this windfall tax, and that we have used that cash to pay about £1,500 per family to cowl individuals’s vitality payments this final winter.

“It might not have felt that approach, however [bills] would have been £1,500 on common larger if we hadn’t taxed the vitality firms,” he added.

[ad_2]

Source link