[ad_1]

Because the UK’s greatest housebuilder by quantity – and its second largest by inventory market worth – there are few higher indicators as to what’s going on within the new construct market than Barratt Developments.

What it needed to say on Thursday, nonetheless, was not particularly encouraging.

The corporate warned it might construct no less than 20% fewer houses this yr.

From 17,206 within the yr to finish of June, Barratt expects this yr to construct between 13,250 and 14,250 new houses within the monetary yr simply began.

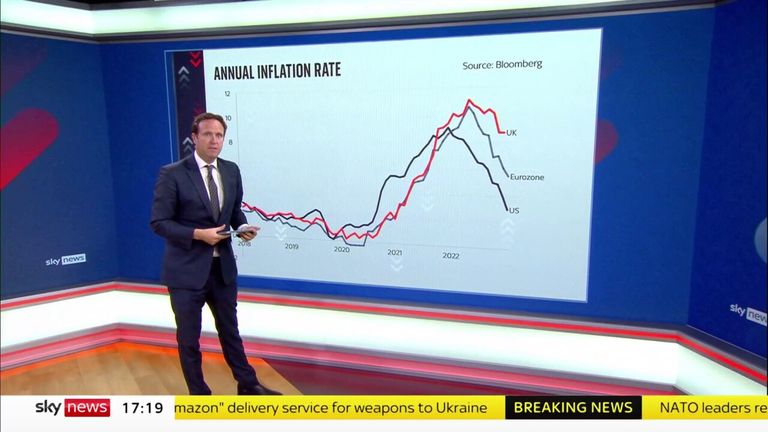

It defined: “Trying forward, we recognise that there are vital macro-economic headwinds, most notably persistent inflation and the next interest rate surroundings, which can affect UK financial progress, employment, client confidence and spending.”

Barratt has already observed chillier circumstances.

Complete housing completions within the monetary yr simply ended have been down 3.9% on the earlier 12 months – reflecting what was, very a lot, a yr of two halves. The final six months of 2022 noticed Barratt full 6.9% extra houses on the identical interval in 2021 however, through the first six months of 2023, completions have been off 12.8% on the identical interval a yr earlier.

That change in fortunes suggests the latest speedy tempo of rate of interest rises from the Financial institution of England is beginning to have an effect on homebuyers and, specifically, on first time consumers.

The corporate mentioned: “Following the top of Assist to Purchase and will increase in mortgage rates of interest, first time purchaser reservations within the yr diminished by 49% in comparison with [the year to the end of June 2022] and accounted for greater than half the decline in our complete reservation fee.

“Demand amongst present householders was extra resilient.”

Tactfully, the corporate made no reference to the federal government’s abandonment final November of its goal of constructing 300,000 new houses a yr, an announcement many within the sector imagine has dampened exercise.

The blame for that, many housebuilders imagine, is the federal government itself and, specifically, the Housing Secretary Michael Gove’s watering-down – within the face of strain from Conservative backbenchers – of the necessities for councils to must plan for extra houses.

That got here on prime of Mr Gove’s strong-arming of housebuilders – however not constructing supplies suppliers – to fulfill the price of changing cladding on condominium blocks across the nation within the wake of the 2017 Grenfell Tower fireplace.

As one housebuilding trade supply informed the trade publication Property Week this week: “Gove appears to despise the housing trade and desires to break it.”

Whereas shares of Barratt fell by 4.5% at one level on the replace, dragging down fellow FTSE 100 builders Persimmon, Berkeley Group and Taylor Wimpey, there have been a couple of crumbs of consolation within the assertion.

One is that the corporate expects to see inflation begin to ease this yr. Whereas construct value inflation got here in at between 9-10% within the monetary yr simply ended, the corporate expects that to abate this yr, dropping to “round 5%”.

One other – extra a reason behind satisfaction for shareholders than would-be homebuyers – is that pre-tax earnings are anticipated to be consistent with market expectations and that, extra importantly, Barratt – like a lot of its friends – is in a a lot more healthy monetary form than it and different housebuilders have been when rates of interest have been final this excessive 15 years in the past and the monetary disaster was getting underway.

Barratt mentioned right now that, on the finish of the final monetary yr, it had web money of £1.070bn even after finishing a £200m share buy-back and spending £820m on land through the yr.

That’s fairly a distinction with the state of affairs this time in 2008 when, having blown £2.2bn the earlier yr on rival Wilson Bowden, Barratt had money owed of £1.7bn supported by fairness of simply £317m. The corporate subsequently wrote down the worth of its land financial institution by greater than £590m and, in September 2009, was obliged to boost £720m by way of a sale of recent shares.

Learn extra:

Almost one million households face £500 a month mortgage hike, Bank of England warns

Average two-year fixed mortgage hits 15-year high

Neither is the present state of affairs comparable with the one the corporate went by way of through the housing crash of the early Nineties when Barratt almost went bust and its legendary founder, Sir Lawrie Barratt, was obliged to return out of retirement and lead a turnaround.

Now it’s price mentioning that, to this point, home costs have fallen solely modestly in contrast with occasions within the early Nineties or round 2008-09.

And there are indicators of storm clouds gathering over the market, as proven by Financial institution of England information revealed right now, which advised that the variety of defaults on mortgage funds has elevated by the best quantity since 2009.

However housebuilders like Barratt, based mostly on the expertise of previous boom-and-bust housing market cycles, seem higher positioned to deal with no matter is coming this time round.

As Sanjiv Tumkur, head of fairness analysis at Rathbone Funding Administration, informed Sky Information right now: “When you step again, the housebuilders have realized the teachings from earlier downcycles. They have sturdy stability sheets.

“Barratt has a web money place of greater than £1bn – that ought to give folks confidence that, regardless of the vagaries of close to time period buying and selling, the corporate is nicely positioned in the long run and can have the stability sheet to reap the benefits of alternatives in the event that they see land costs fall.”

[ad_2]

Source link