[ad_1]

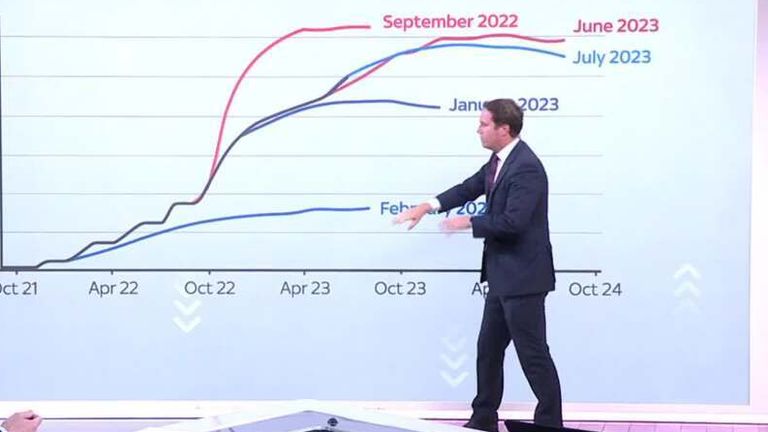

Mounted mortgage charges have risen once more after a short fall, in response to the most recent market knowledge.

The common two-year home-owner mortgage charge in the marketplace edged again as much as 6.8% on Friday from 6.79% yesterday, monetary data firm Moneyfacts stated.

5-year fixes have additionally risen barely again to six.32%, up from 6.31% on Thursday.

The fleeting dip was the first time average mortgage rates had fallen for months.

Nearly all of UK mortgage holders are on fixed-rate offers.

Greater than 400,000 individuals had been anticipated to maneuver off current mounted offers between July and September, which means they’re prone to be compelled to enroll to larger month-to-month repayments.

Click to subscribe to the Sky News Daily wherever you get your podcasts

On Wednesday, it emerged inflation had fallen extra shortly than anticipated, giving a glimmer of hope for under-pressure mortgage debtors.

The Workplace for Nationwide Statistics stated the patron costs index fell to 7.9% last month, down from 8.7% in May.

The Financial institution of England makes use of base charge rises as a software to chill inflation.

The central financial institution remains to be anticipated to boost rates of interest – at present at 5% – at its subsequent assembly on 3 August because it battles to deliver inflation again to its 2% goal.

Learn extra on Sky Information:

Not all shops display prices as clearly as they should – watchdog

Retail sales jumped 0.7% last month

However specialists have stated the bigger-than-expected fall in inflation may see the Financial institution’s policymakers go for a smaller improve of 0.25 share factors relatively than one other 0.5 share level rise.

Rachel Springall of Moneyfacts stated: “The mortgage market has seen some aggressive offers floor this week, however will probably be right down to the borrower to resolve whether or not now’s the time to seize a deal or wait and see what could floor within the coming weeks.

“There are large hopes rates of interest on mortgages will fall, nevertheless it may take just a few weeks for that type of sentiment to floor available in the market – particularly with one other base charge determination on the horizon.”

Total, mortgage payments for anybody who has just lately agreed to a brand new mounted charge are nonetheless up markedly from the years of ultra-low rates of interest.

Lower than two years in the past, in October 2021, the typical charge on a five-year deal was simply 2.55%.

Greater than 2.4 million fixed-rate offers had been set to run out from summer season to the top of 2024, in response to banking trade commerce physique UK Finance.

[ad_2]

Source link