[ad_1]

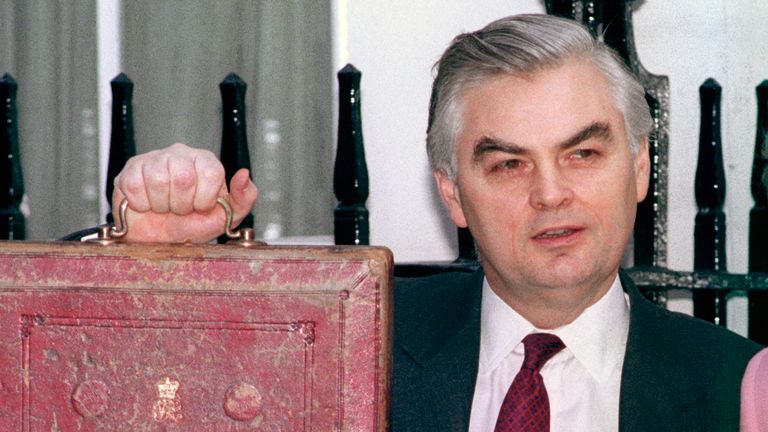

Among the many many tributes being paid to the late Conservative chancellor Nigel Lawson, maybe probably the most putting got here from Nicholas Macpherson, a former everlasting secretary to the Treasury.

Lord Macpherson tweeted: “One of many nice Chancellors of the twentieth century.

“His microeconomic reforms significantly on tax have been each daring and substantial, and have stood the take a look at of time. His mental vitality and openness to debate was inspirational within the Treasury of the Nineteen Eighties.”

That may be a enormous testimony coming from somebody who labored at HM Treasury for practically 30 years and who served each chancellor from Lord Lawson to George Osborne.

Few individuals, no matter their political persuasion, dispute Lord Lawson’s achievements.

Ranking the post-war chancellors

However the place does he stand within the pantheon of post-war chancellors?

A really private view is that, whereas Lawson (1983-89) was definitely one of many best post-war chancellors, he was not the best.

Whereas he was an imaginative and brave reformer, whose actions each inside and outdoors the Treasury undoubtedly boosted the competitiveness of the UK economic system and the dwelling requirements of many Britons, he additionally presided over an inflationary over-heating within the economic system that finally led to the recession of the early Nineties.

No, the accolade of Britain’s greatest post-war chancellor should certainly go to his predecessor Geoffrey Howe (1979-1983), a reforming chancellor who did a lot of the heavy lifting that made attainable Lawson’s later tax-cutting reforms.

Life within the Seventies

For anybody who was not there on the time, it’s nearly not possible to explain the depths to which the UK economic system had sunk throughout the late Seventies, the sheer state of decrepitude within the public funds and, certainly, the general public realm.

Wanting again, nearly 40 years on, it’s astonishing to assume that Britons have been as soon as topic to overseas trade controls limiting the amount of cash they may take in a foreign country.

Altering that was certainly one of Howe’s many reforms.

Regardless of his low-key manner, Howe was a radical, sweeping away not solely controls on overseas trade (a very revolutionary measure by which he had been inspired by Lawson), but additionally on credit score, pay and dividends.

He was additionally courageous, daring to lift taxes in his 1981 price range, regardless of the nation being in a recession on the time. It was a measure important to revive order to the general public funds even when it got here on the value of hastening the deindustrialisation for which many on the left nonetheless despise the Conservatives.

A present from Ken Clarke

One other Conservative of the 1979-1997 period, Ken Clarke (1993-1997), additionally deserves to rank extremely amongst post-war chancellors.

Clarke, once more, was a daring chancellor unafraid of taking robust choices to strengthen the general public funds.

The general public sector borrowing requirement fell sharply throughout his time in workplace and, admittedly benefiting from a less expensive pound within the wake of ‘Black Wednesday’, he presided over a protracted interval of unbroken progress in GDP.

Clarke bequeathed to his successor, Gordon Brown (1997-2007), an economic system firing on all cylinders. Not that Brown appreciated it.

A fly-on-the-wall ITV documentary, overlaying his early weeks on the Treasury, captured a second at which officers spelled out to the brand new chancellor simply how sturdy an economic system he had inherited. Brown growled in response: “What would you like me to do? Ship a thank-you letter?”

Inadequate credit score but additionally debits for Gordon Brown

Brown’s personal document is decidedly blended.

His best achievement was at hand operational independence to the Financial institution of England – at a stroke giving the monetary markets confidence that the UK was critical about retaining inflation below management.

Rates of interest have been decrease, in consequence, than they’d have been had they continued to be set by politicians.

That, and the power of the general public funds, enabled Brown to preside over one of many lengthy intervals of financial progress in British historical past.

One other superb achievement – one for which he in all probability doesn’t obtain ample credit score – was resisting the urgings of Tony Blair, his prime minister, for Britain to affix the eurozone.

Within the debit column, Brown’s controversial tax raid on pensions early in his chancellorship did monumental and lasting harm to retirement financial savings on this nation.

That only a few non-public sector employees now take pleasure in gold-plated ‘closing wage’ pensions now’s a direct consequence of that raid.

It was additionally below Brown, who constantly borrowed greater than he had beforehand forecast, that the progressive deterioration within the UK’s public funds started.

Brown additionally launched extra complexity into the tax code that harm Britain’s competitiveness whereas his shake-up of monetary regulation, stripping the Financial institution of regulatory oversight of the banking sector, was arguably a contributing issue behind why the UK suffered extra harm from the worldwide monetary disaster than a few of its friends.

Underrated chancellors

Some chancellors are under-rated on the time and particularly on the time they go away workplace.

Into this class falls Norman Lamont (1990-1993), chancellor on the time of Black Wednesday, whose tenure on the Treasury is now extra kindly regarded by financial historians now than it was by commentators on the time.

It additionally applies to Roy Jenkins (1967-1970), who restored stability to the economic system following the devaluation disaster of November 1967, whereas additionally being unafraid to impose austerity regardless of it proving politically parlous.

Jenkins additionally left one of the vital memorable and lasting quotes of any chancellor along with his quip that inheritance tax is “a voluntary levy paid by those that mistrust their heirs greater than they dislike the Inland Income”.

Troublesome to evaluate chancellor

Some chancellors are unlucky in that their phrases of workplace have been simply too quick for a correct evaluation of how properly they did.

John Main (1989-1990) falls into that class, as do a lot of the chancellors of the Nineteen Fifties, with the attainable exception of Peter Thorneycroft (1957-1958), who is typically described as a ‘John the Baptist’ determine for Howe, such was his willpower to convey public spending below management and convey order to the general public funds.

Learn extra:

Former chancellor Nigel Lawson dies

The life of Thatcher’s chancellor, from political clashes to the Big Bang and climate scepticism

Different chancellors are tough to evaluate as a result of their phrases of workplace coincided with nice nationwide crises that make it arduous to evaluate how properly they may have completed in different circumstances.

Some would argue that applies to Hugh Dalton (1945-1947) though it have to be mentioned that, over time, his tenure on the Treasury has turn out to be much less kindly considered.

It in all probability applies, although, to Alistair Darling (2007-2010), to whom fell the duty of navigating the economic system by way of the monetary disaster and its aftermath and to Philip Hammond (2016-2019), the primary chancellor to attempt to handle the economic system because the UK went by way of the convulsions which adopted the Brexit referendum.

However the one chancellor who did handle the economic system by way of a disaster and who demonstrably succeeded in that activity, although, is Howe.

[ad_2]

Source link