[ad_1]

In a new report, UNCTAD tasks that annual development throughout giant elements of the worldwide financial system shall be beneath pre-pandemic ranges in 2023.

Excessive rates of interest mixed with hovering debt ranges will add to the “crushing” impact on growing nations over the approaching years, to the tune of a minimum of $800 billion.

The UN physique says that this may “additional deepen the cost-of-living disaster that their residents are at present going through and amplify inequalities worldwide”.

Debt misery slows improvement

In accordance with UNCTAD, “rates of interest hikes will price growing nations greater than $800 billion in foregone revenue over the approaching years”, as debt servicing prices rise on the expense of funding and public spending.

In 2022, borrowing prices, measured by way of sovereign bond yields, elevated from 5.3 per cent to eight.5 per cent for 68 rising markets.

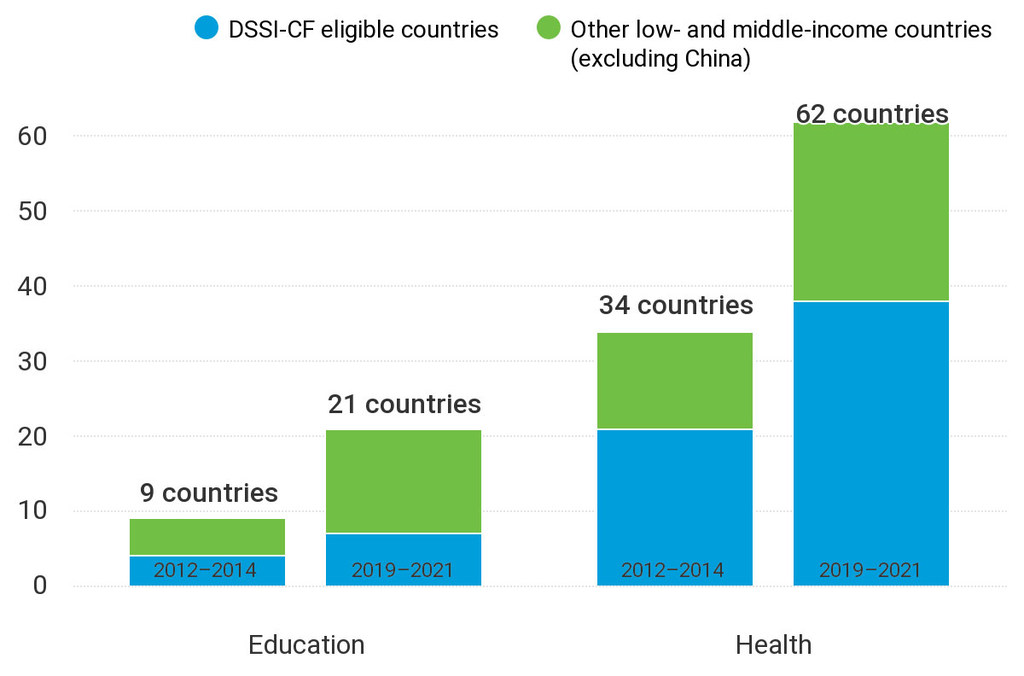

The report says that during the last decade, debt servicing prices have constantly outpaced public expenditure on important providers, and that “the variety of nations spending extra on exterior public debt service than healthcare elevated from 34 to 62 throughout this era”.

Final 12 months, UN Deputy Secretary-Common Amina Mohammed had warned towards this dynamic, calling it “a trade-off between investments in debt and investments in folks”.

Public funding in growing nations will proceed to endure as nations pay extra to their exterior collectors than they obtain in new loans. This was the case of 39 nations in 2022, with probably devastating penalties for improvement, social safety and the broader struggle towards inequalities, UNCTAD famous.

Liquidity crunch

In the meantime, worldwide liquidity is drying up for growing economies. The report discovered that 81 growing nations (excluding China) misplaced $241 billion in worldwide reserves in 2022, or seven per cent on common.

UNCTAD says that greater than 20 nations skilled a drop of over 10 per cent, “in lots of circumstances exhausting their current addition of Particular Drawing Rights”.

Special Drawing Rights (SDRs) are a world reserve asset created by the Worldwide Financial Fund (IMF) to complement the official international alternate reserves of its member nations and assist present them with liquidity. The largest-ever allocation of SDRs, price $650 billion, was carried out by the IMF in August 2021 to help nations by way of the financial disaster resulting from COVID-19.

Amid the liquidity shortfall, UNCTAD warns that 500 million folks dwelling in 37 nations “are prone to proceed struggling for years to return from the implications of a world monetary system unable to reply on the scale and on the pace wanted to face the systemic shocks affecting the growing world”.

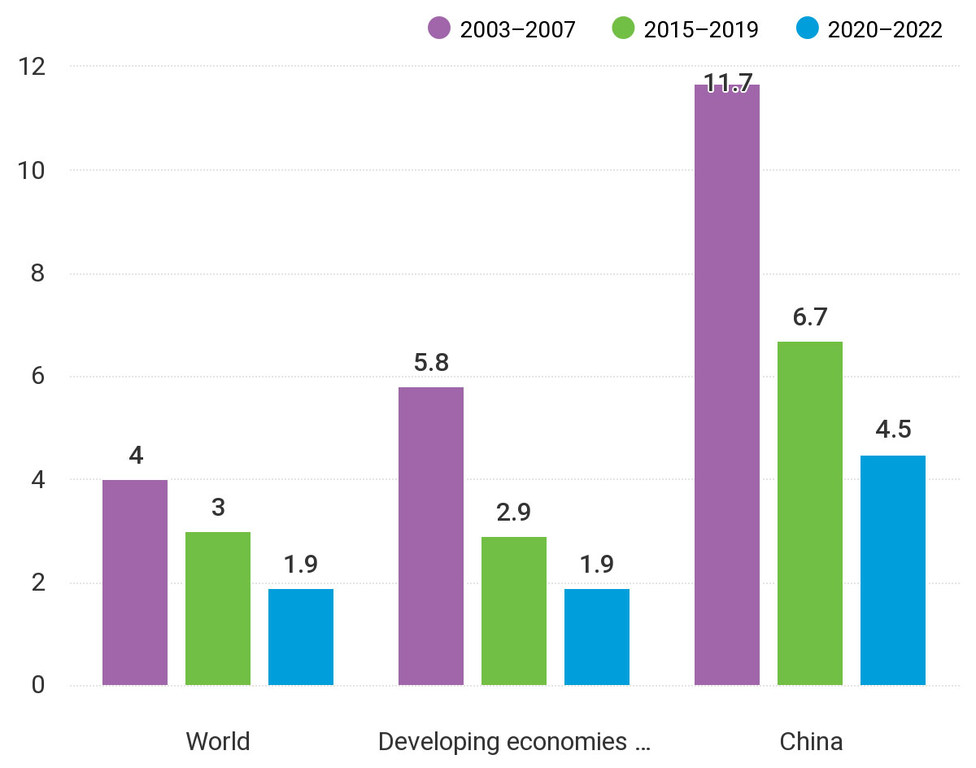

Common development fee.

Price-of-living disaster

The report highlights that meals inflation stays rampant in growing nations in early 2023, contributing to a excessive price of dwelling.

This echoes the latest assessment of the UN Meals and Agriculture Group (FAO), which mentioned that regardless of 12 consecutive months of decreases as of March 2023, international meals costs stay 30 per cent greater immediately in comparison with the common degree noticed in 2020, and lots of low and middle-income nations are experiencing double-digit meals value inflation.

Excessive meals costs put meals safety in peril, “notably in internet meals importing growing nations, with the scenario aggravated by the depreciation of their currencies towards the US greenback or the Euro and mounting debt burden”, in response to FAO Chief Economist Máximo Torero.

UNCTAD additional warns that prime rates of interest and inflated meals and vitality costs will proceed to weaken family spending and enterprise funding.

Reforming debt structure

Amongst its suggestions, UNCTAD says that an “pressing focus” on the reform of world debt structure is required to adequately handle growing nations’ wants.

Transport corporations are working in direction of sustainable maritime transport as a part of the Sustainable Improvement Targets.

Among the many UN commerce physique’s suggestions is the institution of a multilateral “debt exercise mechanism”, a registry of validated knowledge on debt transactions from each lenders and debtors, and improved debt sustainability analyses which take note of improvement and local weather finance wants.

Strengthening improvement finance

These suggestions echo UN Secretary-General António Guterres’ call earlier this year to take motion towards the excessive price of debt and scale up long-term financing for improvement.

Again in February, Mr. Guterres proposed an annual stimulus bundle to bridge the “nice monetary divide” between developed and growing nations and assist obtain the Sustainable Development Goals (SDGs) by 2030.

The “SDG Stimulus” proposal additionally insisted on increasing contingency financing to nations in want and extra computerized issuing of Particular Drawing Rights in occasions of disaster.

New Particular Drawing Rights

UNCTAD’s report says that issuing new Particular Drawing Rights “price a minimum of $650 billion” can be a “constructive first step in serving to to alleviate the heavy debt burdens” which might be placing improvement in jeopardy.

The report shall be a part of the contribution the UN commerce physique is making to the worldwide discussions at present underway in Washington DC on the IMF/World Bank meetings, together with on debt and financing. The UN commerce physique views the conferences as “a invaluable alternative” to strengthen improvement finance and enhance liquidity prospects.

Variety of nations spending extra money on dept in comparison with chosen sectors, 2019–2021 vs. 2012–2014.

[ad_2]

Source link