[ad_1]

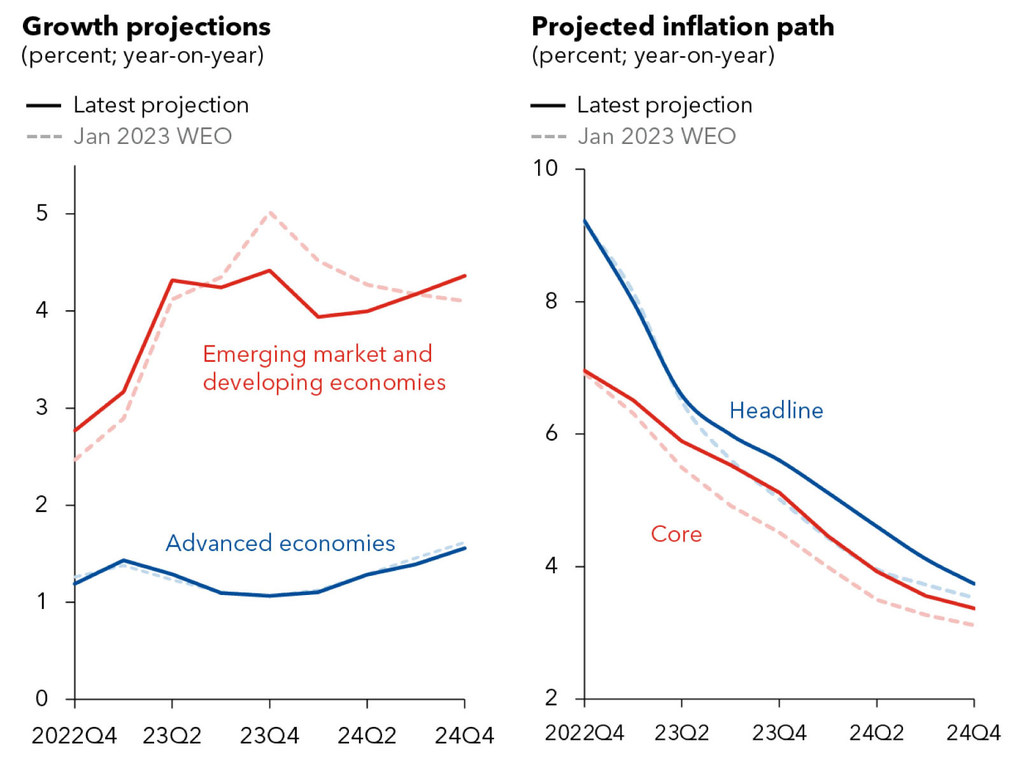

International inflation can be heading down, signalling that the tightening of financial coverage by main rate of interest rises is bearing fruit, although extra slowly than initially anticipated, stated the IMF’s Director of Research, from 8.7 % final 12 months to seven % this 12 months, and 4.9 % in 2024.

Gradual restoration ‘stays on monitor’

Pierre-Olivier Gourinchas stated the gradual international restoration from each the pandemic and Russia’s invasion of Ukraine “stays on monitor”, with China’s reopened financial system rebounding strongly, whereas beforehand disrupted provide chains are unwinding.

He stated this 12 months’s financial slowdown is concentrated in superior economies, particularly the Eurozone and in the UK, “the place progress is predicted to fall to 0.8 % and -0.3 % this 12 months earlier than rebounding to 1.4 and 1 % respectively.”

In distinction, regardless of a 0.5 share level downward revision, many rising market and growing economies are selecting up, with progress accelerating to 4.5 % by the tip of 2023 from 2.8 % on the shut of 2022.

‘Fragile’ actuality

The IMF Director, who additionally serves as Financial Counsellor, warned that because the current instability triggered by the collapse of Silicon Valley Financial institution and others, reveals “the scenario stays fragile. As soon as once more, draw back dangers dominate and the fog world wide financial outlook has thickened.”

He stated inflation was nonetheless stubbornly excessive, greater than anticipated by the markets, whereas falling inflation was primarily as a result of falling vitality and meals costs. Solely at present, the UN’s meals company (FAO) worth index, confirmed one other fall, 20 per cent down on the worrying excessive of a 12 months in the past. Nonetheless, that fall has not translated into comparable declines in most supermarkets for many shoppers.

Inflation persists

“We anticipate year-end to year-end core inflation will gradual to five.1 % this 12 months, a sizeable upward revision of 0.6 share factors from our January replace, and effectively above goal”, stated Mr. Gourinchas.

He stated that labour markets – mirrored in low unemployment charges – “stay very robust in most superior economies”, which “might name for financial coverage to tighten additional or to remain tighter for longer than presently anticipated.”

He stated he remained “unconvinced” that there was an enormous threat of an uncontrolled wage-price spiral, with nominal wage good points persevering with to lag behind worth will increase, implying a decline in actual wages.

IMF, April 2023 World Financial Outlook; and IMF employees calculations.

By no means a straightforward trip

He stated extra worrying have been the negative effects that the sharp rate of interest rises of the final 12 months have been having on the monetary sector, “as we’ve got repeatedly warned may occur. Maybe the shock is that it took so lengthy.”

He argues that as a result of a chronic interval of muted inflation and low rates of interest earlier than the worldwide shocks of COVID and the Ukraine conflict, the monetary sector had “turn out to be too complacent”.

The transient instability within the UK gilt market final autumn and the current banking turbulence within the US “underscore that important vulnerabilities exist each amongst banks and nonbank financial intermediaries. In each instances, monetary and financial authorities took fast and robust motion and, thus far, have prevented additional instability”, he reassured.

Jitters nonetheless robust

He concluded by warning {that a} sharp tightening of worldwide monetary situations as a result of a so-called ‘risk-off’ occasion, when buyers rush to play secure and promote belongings, “may have a dramatic impression on credit score situations and public funds, particularly in rising market and growing economies. It could precipitate giant capital outflows, a sudden improve in threat premia, a greenback appreciation in a rush to security, and main declines in international exercise amid decrease confidence, family spending and funding.”

In that occasion, he stated, progress may gradual to only one % this 12 months, implying close to stagnant per capita revenue. However that is unlikely to occur, the IMF Director suggests: “We estimate the chance of such an end result at about 15 %.”

[ad_2]

Source link