[ad_1]

There was a shock rise in retail gross sales final month regardless of inflationary strain and rising borrowing prices, official figures present.

The Workplace for Nationwide Statistics (ONS) mentioned retail gross sales volumes grew by 0.3% in Could, barely lower than the 0.5% growth in April and much better than the 0.2% decline forecast by economists, as heat climate and the King’s coronation and Could financial institution holidays, boosted on-line gross sales of outside items and summer time garments.

Backyard centres and DIY outlets additionally benefitted.

Extra was spent on takeaways and quick meals throughout the month as individuals celebrated the coronation and the same old Could financial institution vacation. However meals retailer gross sales fell as supermarkets elevated costs, the ONS mentioned.

Meals inflation has risen nearly 20% within the 12 months as much as April.

Probably because of the low variety of rail strikes petrol gross sales elevated 1.7% within the month, up from a 1.7% contraction in April.

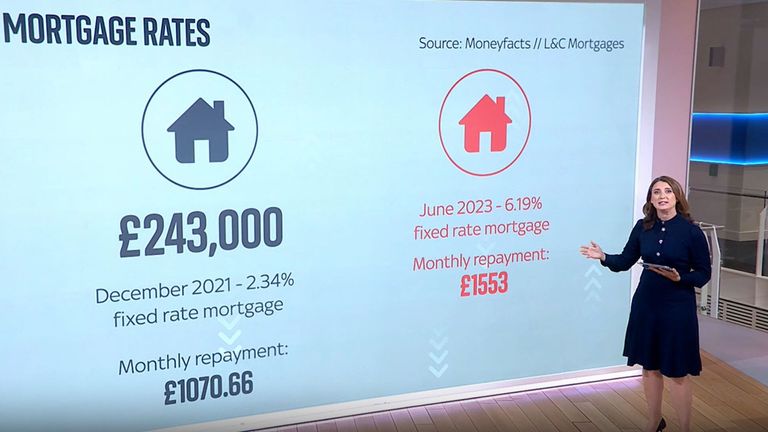

The figures cowl the month the place mortgage rates increased further.

On the time, rates of interest have been projected to rise increased in response to a rise in core inflation, a measure of worth rises excluding unstable classes equivalent to meals and gas, to what had been the highest level in 30 years.

Additionally launched on Friday was a intently watched index of purchaser sentiment, which mentioned client confidence is at its strongest in 17 months and grew for the fifth month in a row.

The survey, by analysis group GfK, didn’t cowl knowledge for Wednesday and Thursday when shock inflation figures and a Bank of England interest rate rise have been introduced.

Total the figures suggests the economic system has been resilient to the shocks of inflation and rates of interest.

Financial analysis agency Pantheon Macro sees positives within the coming months.

“The excellent news is that households’ actual disposable incomes will probably be boosted by 0.8% in July by a pointy fall in vitality costs,” the group’s senior UK economist mentioned.

“This increase ought to outweigh the drag from mortgage refinancing, which possible will subtract a mere 0.2 share factors from quarter-on-quarter progress in households’ actual disposable incomes over the approaching quarters, provided that solely 30% of households have a mortgage and solely 7% of fixed-rate mortgages have to be refinanced each quarter.”

The view shouldn’t be universally held and financial analysis enterprise Capital Economics mentioned.

“Our view continues to be that the rising drag on exercise from increased rates of interest will ultimately tip the economic system into recession, producing a 0.5% peak to trough fall in actual client spending”.

[ad_2]

Source link