[ad_1]

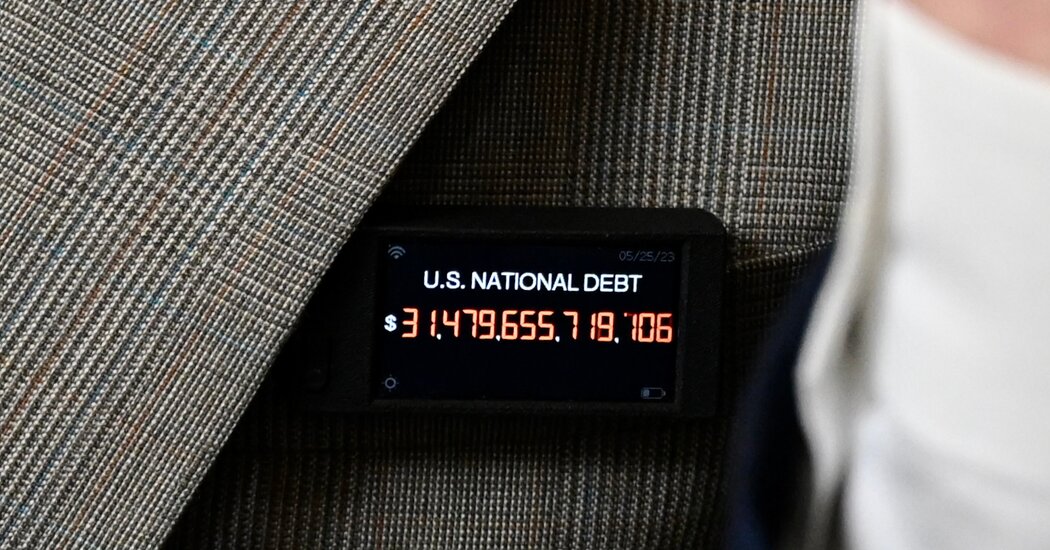

The bipartisan deal to avert a authorities default this week featured modest cuts to a comparatively small nook of the federal finances. As a curb on the expansion of the nation’s $31.4 trillion debt load, it was a minor breakthrough, at finest.

It additionally confirmed how tough — maybe inconceivable — it might be for lawmakers to agree anytime quickly on a serious breakthrough to demonstrably scale back the nation’s debt load.

There isn’t a clear financial proof that present debt ranges are dragging on financial development. Some economists contend that rising debt ranges will harm development by making it harder for businesses to borrow money; others say spiraling future prices of presidency borrowing may unleash rapid inflation.

However Washington is again to pretending to care about debt, which is poised to high $50 trillion by the top of the last decade even after accounting for newly handed spending cuts.

With that pretense comes the fact that the basic drivers of American politics all level towards the US borrowing extra, not much less.

The bipartisan settlement to droop the debt ceiling for 2 years, which handed the Senate on Thursday, successfully units general discretionary spending ranges over that interval. The settlement cuts federal spending by $1.5 trillion over a decade, in keeping with the Congressional Price range Workplace, by basically freezing some funding that had been projected to extend subsequent 12 months after which limiting spending to 1 % development in 2025.

However even with these financial savings, the settlement supplies clear proof that the nation’s general debt load is not going to be shrinking anytime quickly.

Republicans cited that mounting debt burden as a purpose to refuse to lift the restrict, risking default and monetary disaster, until Mr. Biden agreed to measures to scale back future deficits. However negotiators from the White Home and Home Republican management may solely agree to search out main financial savings from nondefense discretionary spending.

That’s the a part of the finances that funds Pell grants, federal regulation enforcement and a variety of home packages. As a share of the financial system, it’s properly inside historic ranges, and it’s projected to fall within the coming years. Presently, base discretionary spending accounts for lower than one-eighth of the $6.3 trillion the federal government spends yearly.

The deal included no main cuts to navy spending, which is bigger than base nondefense discretionary spending. Early within the talks, each events dominated out adjustments to the 2 largest drivers of federal spending development over the subsequent decade: Social Security and Medicare. The price of these packages is predicted to soar inside 10 years as retiring child boomers qualify for advantages.

Whereas Republicans at first balked when Mr. Biden accused them of wanting to chop these politically common packages, they rapidly switched to blaming the president for taking them off the desk.

Requested on Fox Information on Wednesday why Republicans had not focused your complete finances for cuts, Speaker Kevin McCarthy replied, “As a result of the president walled off all of the others.”

“The bulk driver of the finances is obligatory spending,” he stated. “It’s Medicare, Social Safety, curiosity on the debt.”

Negotiators for Mr. McCarthy successfully walled off the opposite half of the debt equation: income. They rebuffed Mr. Biden’s pitch to lift trillions of {dollars} from new taxes on companies and excessive earners, and either side wound up agreeing to chop funding for the Inside Income Service that was anticipated to usher in more cash by cracking down on tax cheats.

As a substitute, Republicans tried to border mounting nationwide debt as solely a spending downside, not a tax-revenue downside, regardless that tax cuts by each events have added trillions to the debt for the reason that flip of the century.

Republican leaders now seem poised to introduce a brand new spherical of tax-cut proposals, which might possible be financed with borrowed cash, a transfer Democrats decried through the flooring debate over the debt-ceiling deal.

“Earlier than the ink is dry on this invoice, you’ll be pushing for $3.5 trillion in enterprise tax cuts,” Consultant Gwen Moore, Democrat of Wisconsin, stated shortly earlier than the ultimate vote on the Fiscal Duty Act, as it’s referred to as, on Wednesday.

These feedback mirrored a lesson Democrats took from 2011, when Washington leaders final made an enormous present of pretending to care about debt in a bipartisan deal to lift the borrowing restrict. That settlement, between President Barack Obama and Speaker John Boehner, restricted discretionary spending development for a decade, serving to to drive down finances deficits for years.

Many Democrats now consider these decrease deficits gave Republicans the fiscal and political house they wanted to cross a tax-cut bundle in 2017 below President Donald J. Trump that the Congressional Price range Workplace estimated would add practically $2 trillion to the nationwide debt. They’ve come to consider that Republicans would fortunately do the identical once more with any future finances offers — putting aside deficit concerns and successfully turning finances financial savings into new tax breaks.

On the similar time, each events have grown extra cautious of cuts to Social Safety and Medicare. Mr. Obama was willing to reduce future growth of retirement advantages by altering how they have been tied to inflation; Mr. Biden isn’t. Mr. Trump received the White Home after promising to guard each packages, in a break from previous Republicans, and is at present slamming his rivals over attainable cuts to the packages as he seeks the presidency once more.

All of the whereas, the full quantity of federal debt has greater than doubled, to $31.4 trillion from slightly below $15 trillion in 2011. That development has had no discernible impact on the efficiency of the financial system. However it’s projected to proceed rising within the subsequent decade, as retiring child boomers draw extra authorities advantages. The finances workplace estimated final month that debt held by the general public could be practically 20 % bigger in 2033, as a share of the financial system, than it’s right now.

Even below a beneficiant rating of the brand new settlement, which assumes Congress will successfully lock in two years of spending cuts over the total course of a decade, that development will solely fall by just a few share factors.

Teams selling debt discount in Washington have celebrated the deal as a primary step towards a bigger compromise to scale back America’s reliance on borrowed cash. However neither Mr. McCarthy nor Mr. Biden has proven any curiosity in what these teams need: a mixture of vital cuts to retirement packages and will increase in tax revenues.

Mr. McCarthy recommended this week that he would quickly kind a bipartisan fee to scour the total federal finances “so we will discover the waste and we will make the true selections to actually deal with this debt.”

The 2011 debt deal produced an analogous kind of fee, which issued suggestions on politically painful steps to scale back debt. Lawmakers discarded them. There’s no proof they’d do the rest right now.

[ad_2]

Source link