[ad_1]

Jeremy Hunt has instructed Sky Information he’s comfy with Britain being plunged into recession if that is what it takes to convey down inflation.

The chancellor stated that he would totally help the Financial institution of England elevating rates of interest increased, doubtlessly in direction of 5.5%, because it battled higher-than-expected costs.

Requested by Sky Information whether or not he was “comfy with the Financial institution of England doing no matter it takes to convey down inflation, even when that doubtlessly would precipitate a recession”, he stated: “Sure, as a result of ultimately, inflation is a supply of instability.

“And if we need to have prosperity, to develop the financial system, to cut back the chance of recession, now we have to help the Financial institution of England within the tough selections that they take.

“I’ve to do one thing else, which is to ensure the selections that I take as chancellor, very tough selections, to stability the books in order that the markets, the world can see that Britain is a rustic that pays its means – all this stuff imply that financial coverage on the Financial institution of England (and) fiscal coverage by the chancellor are aligned.”

The feedback got here after market expectations for the eventual peak of UK rates of interest leapt dramatically, following higher-than-expected CPI inflation data this week.

Whereas the anticipated peak for UK charges was somewhat above 4.75% final week, it lurched increased, to five.5%, following Wednesday’s statistics. Save for the gyrations after the mini-budget final autumn, it was the most important shift in rate of interest expectations since 2008.

Prime Minister Rishi Sunak pledged in January that he would halve inflation this year, which in follow means bringing it down to only above 5% by the top of 2023. The Financial institution of England’s forecasts earlier this week recommended he would narrowly succeed.

Learn extra:

Grocery inflation eases for second consecutive month

Government borrowing sharply higher than expected

Nevertheless, because the newest inflation information is considerably increased than the Financial institution’s forecast trajectory, the pledge could also be missed.

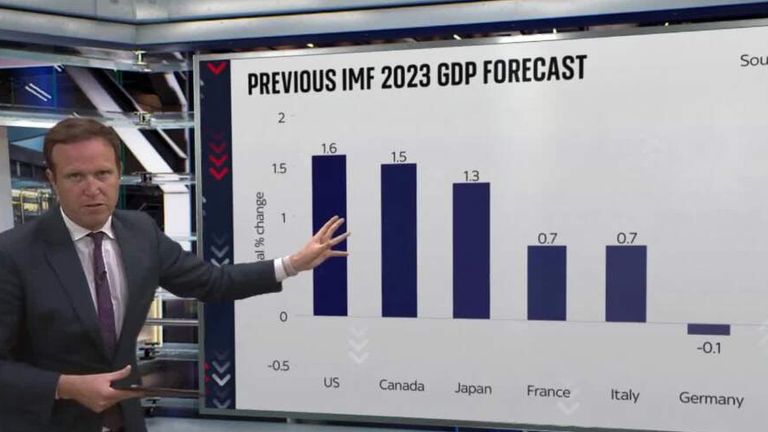

However the prime minister additionally pledged to develop the financial system. And whereas the Worldwide Financial Fund stated this week that the UK would avoid recession, economists consider it is now believable, given these increased rate of interest expectations, that Britain as an alternative sees gross home product contract for 2 quarters – the technical definition of a recession.

Mr Hunt added: “When the prime minister introduced that it was his goal to halve inflation in January, there have been some individuals who derided that, they stated: ‘effectively it is automated, inflation goes to come back down anyhow’.

“There’s nothing automated about bringing down inflation, it’s a massive process, however we should ship it and we’ll.

“It isn’t a trade-off between tackling inflation and recession. Ultimately, the one path to sustainable progress is to convey down inflation.”

[ad_2]

Source link