[ad_1]

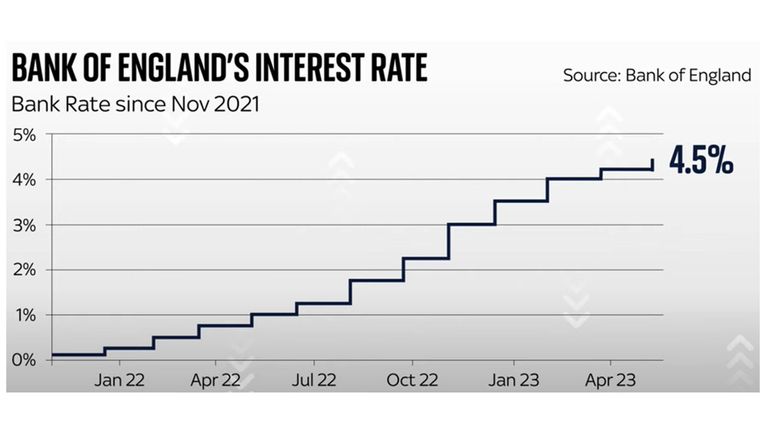

The Financial institution of England has raised rates of interest for a record-breaking twelfth successive time, lifting the price of borrowing to 4.5% and warning that inflation can be greater this 12 months than it beforehand anticipated.

The Financial institution’s Financial Coverage Committee stated that there can be no recession this 12 months, upgrading its financial progress forecasts by greater than in any of its earlier stories.

It’s a dramatic change from only some months in the past, when it was predicting the longest-lived recession in trendy British historical past.

Nevertheless, it nonetheless solely ends in comparatively lacklustre financial progress this 12 months and subsequent.

Whereas it signalled that rates of interest might now be at their peak, the Financial institution additionally stated that it had been shocked by the speed at which meals costs are rising, and that meant that wider inflation – the velocity at which costs are rising every year – can be stickier this 12 months and subsequent.

The Financial institution is now forecasting that inflation shall be round 5% on the finish of this 12 months, moderately than the 4% stage it beforehand forecast.

Meaning the prime minister might come inside a whisker of lacking his goal of halving inflation this 12 months – although the financial institution’s forecasts suggest he’ll narrowly squeak what beforehand appeared like a considerably unambitious goal.

With rates of interest now on the highest stage since 2008, an growing variety of households are feeling the affect of rising borrowing prices, however the Financial institution says solely a 3rd of the ache from greater mortgage funds had but trickled into the economic system.

Learn extra:

Pain still to come for millions despite Bank’s change of heart – analysis

‘Greedflation’ – are businesses making inflation worse?

‘Bleakest’ start to the year for Citizen’s Advice

The coverage committee’s vote to alter rates of interest was cut up, with seven members voting for the quarter share level improve.

However two committee members, Silvana Tenreyro and Swati Dhingra, voted to go away them unchanged.

The committee’s new forecasts counsel the economic system will develop by round 1 / 4 share level this 12 months, in contrast with a earlier forecast of a half share level contraction.

That shall be adopted in 2024 by a three-quarter level improve in gross home product, in contrast with earlier forecasts for 1 / 4 share level fall.

Chancellor Jeremy Hunt he was nonetheless hopeful of reaching his inflation goal however admitted “there’s by no means been something computerized about hitting it”.

He added: “Though it is clearly excellent news the Financial institution is just not now predicting a recession this 12 months, it is very difficult for households with mortgages to see rates of interest go up.

“However, except we sort out rising costs, the price of dwelling disaster will simply proceed and that is why it is important we stick with our plan to halve inflation – and if we try this we will convey certainty again to household funds.”

[ad_2]

Source link